Starter Kit

Here are key materials to help you learn more about the National Flood Insurance Program (NFIP) and the basics of flood insurance, as well as resources for your clients.

You can also sign up for an agent webinar to learn about flood risks in your area, marketing tips and helpful tools for selling flood insurance.

-

Rate Explanation Guide

Image

A detailed overview of what goes into a rate. The guide outlines factors that can identify a building's unique flood risk and associated premium.

-

NFIP Claims Handbook

Image

A handbook detailing what homeowners, renters and business owners can do to prepare for and recover from a flood event. It guides policyholders through each step of the process, like starting a claim.

-

Why Do I Need Flood Insurance Brochure

Image

Share this brochure with your clients to help them understand the importance of flood insurance. This can also be used as a reference for answering common questions.

-

Answers to Questions About the NFIP

Image

Check out this comprehensive guide that addresses frequently asked questions about the NFIP

-

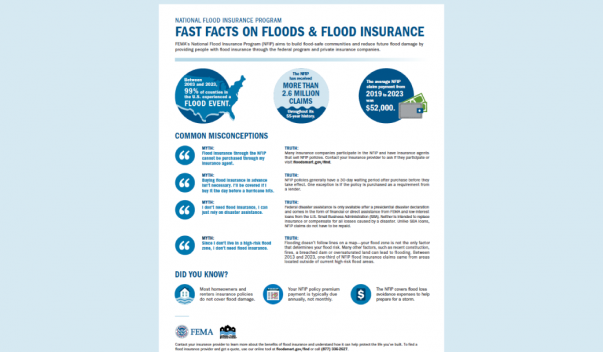

NFIP Fast Facts on Floods & Flood Insurance Infographic

Image

This infographic highlights important facts about flood risk. It also clears up common misconceptions about flooding and flood insurance coverage.

-

Provide a Flood Insurance Quote Infographic

Image

This infographic features key reasons why agents should provide a custom NFIP policy quote to their clients.

-

NFIP Summary of Coverage

Image

Share this brochure to help clients understand their Standard Flood Insurance Policy. It includes their declarations page, what is and isn’t covered, and how the claims process works.

-

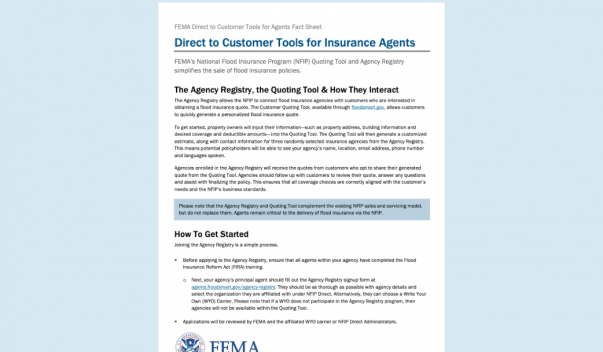

FEMA Direct-to-Consumer Tools for Insurance Agents Fact Sheet

Image

This fact sheet explains the NFIP’s resources that make selling flood insurance easier. It includes information about why and how to sign up for the Agency Registry and Quoting Tool.

-

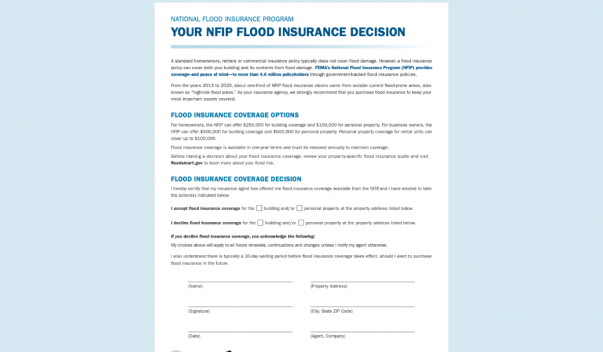

Your NFIP Flood Insurance Decision Flyer

Image

This is a resource that you can give to your clients before making a decision about their flood insurance coverage.