Handling Claims

When a flood happens, agents and their insurance carriers are often the first call a client will make to start their recovery process.

Below are key resources to assist you in helping clients with their claims.

Latest claims resources

-

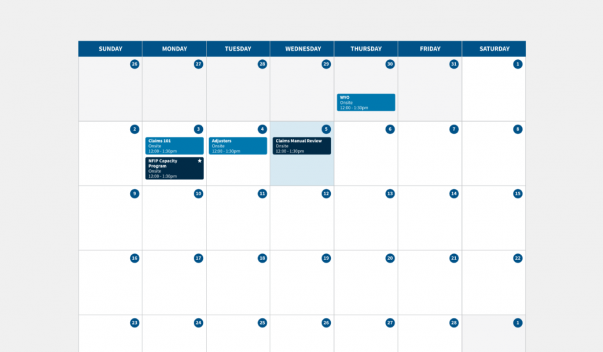

2025 Claims adjuster webinars

Image

Register for upcoming claims adjuster presentations. Adjusters who work on behalf of the National Flood Insurance Program (NFIP) must attend annually to maintain their Flood Control Number (FCN).

-

Adjuster registration

Image

Overview of the Flood Adjuster Capacity Program, including the qualifications and steps required to become a registered NFIP adjuster.

-

Increase Cost of Compliance (ICC) Overview

Image

ICC claims process overview and submission instructions.

-

NFIP Claims Manual

Image

The manual improves clarity of flood insurance claims guidance to NFIP Write Your Own (WYO) companies, flood vendors, flood adjusters and examiners.

-

NFIP Claims Handbook

Image

This handbook provides guidance on the claims and recovery process for homeowners, renters and business owners. It also includes information on preparing for a flood event.

-

Claims Handbook (Spanish)

Image

This handbook provides guidance in Spanish on the claims and recovery process for homeowners, renters and business owners. It includes information on preparing people and property for a flood event.

2023 Flood Adjuster Capacity Program (FACP) Manual

The 2023 NFIP FACP manual was revised based on feedback received from participating Write Your Own (WYO) companies and adjusting firms.

The FACP outlines FEMA’s standards of what every flood insurance professional should know before overseeing or adjusting claims on behalf of the NFIP. It is designed to help increase the number of qualified NFIP adjusters and prepare them to adjust flood claims.

Each participating WYO is encouraged to incorporate their own requirements and standards for adjusters handling their claims in addition to the minimum standards set in the FACP.