Flood-in-Progress Investigations

Damage from a flood that starts before the policy is purchased is not covered, even if the damage happens after the policy goes into effect.

What you need to know about Flood-in-Progress claims and coverage.

-

If a flood is already in progress when someone adds or increases coverage, only the original, lower coverage limits apply.

-

If a new flood happens after the policy starts, the new, higher limits will apply.

-

Flood-in-Progress investigations happen because FEMA is aware that people sometimes buy flood insurance after signs of flooding show up in an area.

-

When adjusting claims where the Flood-in-Progress exclusion may apply, adjusters must thoroughly investigate and document their coverage determination.

-

Adjusters should inform FEMA of potential Flood-in-Progress claims to ensure all insurers are handling claims the same way.

Flood-in-Progress details

The Standard Flood Insurance Policy (SFIP) does not cover damage from a flood that is in progress at the time and date the policy is bought. This means if the flood begins before the policy is purchased, any damage it causes won’t be covered even if the damage happens after the policy's effective date.

When a policyholder asks to add or increase coverage while a flood is already happening, their new coverage will not apply to the flood. This is true even if the damage happens after the new coverage goes into effect, only the original (lower) coverage limits will be used.

But if a flood happens after the effective date of the added or increased coverage, the new (higher) limits will apply.

What prompts a Flood-in-Progress investigation?

FEMA is aware that flood insurance policies are being bought after there is evidence of flooding in the area. Extensive sandbagging or temporary levees should prompt a Flood-in-Progress investigation.

Claim handing considerations

Each claim is looked at on an individual basis to determine if the Flood-in-Progress exclusion should apply. Evidence that a flood may be in progress on the date the policy was bought or changed may include a recent:

- Flood in the same community, caused by the same source as the flood on the insured property, or

- Flood-starting event that causes damage, like a spillway opening, levee breaching, dam releasing water or overflowing waterways (stream, river, creek, etc.).

When adjusting a claim that may involve the Flood-in-Progress exclusion, the adjuster must investigate if a flood had already started when the policy was purchased. The investigation and decision about coverage should be clearly documented in the claim file. It’s important to tell FEMA about any possible Flood-in-Progress claims to make sure all insurers handle them the same way.

- The NFIP Claims Manual provides guidance on when the Flood-in-Progress exclusion may apply, adjustment concerns and how to request assistance.

Flood-in-Progress Resources

-

NFIP Claims Manual

Image

Use the manual for guidance in selling and servicing flood insurance.

-

Flood-in-Progress infographic

Image

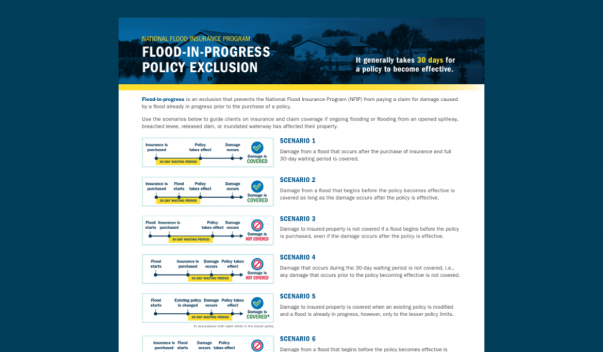

This infographic shows potential scenarios for guidance on insurance and claims coverage if ongoing flooding has affected a property.

-

NFIP trainings

Image

Explore the different courses available for agents and learn more about flood insurance.